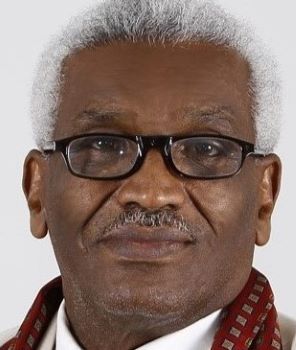

By Dr AbdelGadir Warsama, Legal Counsel

18 April, 2024

Directors and officers must, all through, act in the best interests of the company. They breach their duty if they try to profit personally at the expense of the company. This is what is called “Self-Dealing” for self-gain. In such instances, directors and officers are not prohibited, in all cases, from entering into transactions with the company.

At one time, it was held that such deals were voidable by the company but today the majority of courts treat such deals “voidable” only if unfair to the company. However, before a director enters a contract with the company, he should make a full disclosure of his interest. This requires that the director or officer disclose all material facts of the transaction, including his interest in it.

After full disclosure, the disinterested members of the board or the shareholders themselves must approve the transaction. However, such approval does not automatically relieve the self-dealing director or officer from liability to the company. The initial burden of proving the fairness of the transaction lies with the self-dealing director or officer. After proper approval by the board of directors or shareholders, the burden of establishing unfairness merely shifts to the company.

Directors and officers may not usurp what is called “a corporate opportunity”. Such usurpation occurs when a business opportunity comes to them in their official capacities and the opportunity is within the company’s normal scope of business. There are three elements to be met before directors or officers may be found to have usurped a corporate opportunity. 1st, the opportunity must have come to them in their corporate capacity. 2nd, the opportunity must be related to the corporate business and lastly the corporation \ company must have been able to take advantage of the opportunity.

Even when these three requirements are met, the director may still avoid liability if he can show that the company waived its rights to the opportunity. Thus, if the director offered the opportunity with full disclosure of all material terms and a disinterested majority of the board rejected the transaction, the director may take it.

In instances, where shareholders complain that they have been unfairly treated by the directors, there are some suits from shareholders claiming a “freeze-out” by receiving cash rather than receiving stocks in the new company. Sometimes, the shareholders claim “oppression”, this happens when some shareholders are not receiving dividends. Usually, minority shareholders win such suits only where the acts of directors have clearly been in bad faith or have clearly abused the discretion given the directors by the law.

Also, when directors and officers buy or sell the company’s stock, they may be in violation of their fiduciary duties of “insider information”. Any disclosure of the confidential information they have acquired through their position with the company might have a profound effect on the value of the company’s securities. Yet current judicial trends point toward a greater duty to disclose all material information to the buyers and sellers of stock. As a result, the federal securities laws prohibit insiders, those with confidential material information concerning the company, from buying or selling its stock.

A director who assents to any of the actions of the board of directors may be held liable if the board has failed to abide by its duties to the company. Any director who attends a board meeting is held to have assented to the board’s actions unless he specifically dissents. Legally, a director will not have dissented unless he refuses to vote for the proposed course of action and makes this dissent clear to the other board members by having it appear in the minutes or by giving a written notice of dissent to the chairman or secretary immediately following the meeting.

To sum up, all directors & officers in companies, are required to solely act for the interest of the company and to refrain from personal gains at the cost of the company. There are legal, ethical & professional boundaries to be fully observed and strictly followed. Please, be up to standard and give an excellent model for yourself and others.